The process of generating home insurance leads is about drawing in potential buyers and turning that interest into sales. The biggest downside of most lead gen? You are overwhelmed with contacts that not a single one is worth your time losing.

Home insurance lead generation quizzes are the remedy. They not only qualify leads but also automatically gather detailed information on the property, the coverage needed, and the buyer’s intent. This is the same strategy used in many lead generation quizzes to attract and filter high-intent prospects. What you have are leads that are qualified as per your set criteria, along with all the data needed for the closing process.

What are Home Insurance Leads

It’s a whole different story how you handle the leads, depending upon the lead types you are dealing with. Just attracting potential customers is not enough, but understanding leads matters a lot. Every lead is different, and knowing the situation helps you to allocate your time and resources accordingly.

Fresh leads are the ideal ones to work with. These people have just put out their request for information within the last 24 hours. They are on fire, eager to talk, and their conversion rates are much higher. The only disadvantage? They come at a price of $10 to $50 per lead.

Aged leads are those potential customers that you contacted weeks or months ago. They are less expensive (usually $0.75-$3 per lead), but you will have to put more effort into reacquainting them with your product.

Exclusive leads are those meant just for you. The shared leads are the ones that are sold to multiple agents. The exclusive leads convert better, but their price is higher initially.

There is something really interesting. The leads coming from online searches have a closing rate that is five times higher than the other lead types. Insurance seekers who start their journey on Google are not simply browsing. They are comparing, doing research, and making decisions. This is the reason that positioning a strong home insurance leads quiz funnel, where active shoppers can find i,t becomes vital for your lead generation success.

Benefits of Using a Home Insurance Leads Quiz Funnel

Using a home insurance lead generation quiz delivers measurable advantages that traditional forms simply can’t match.

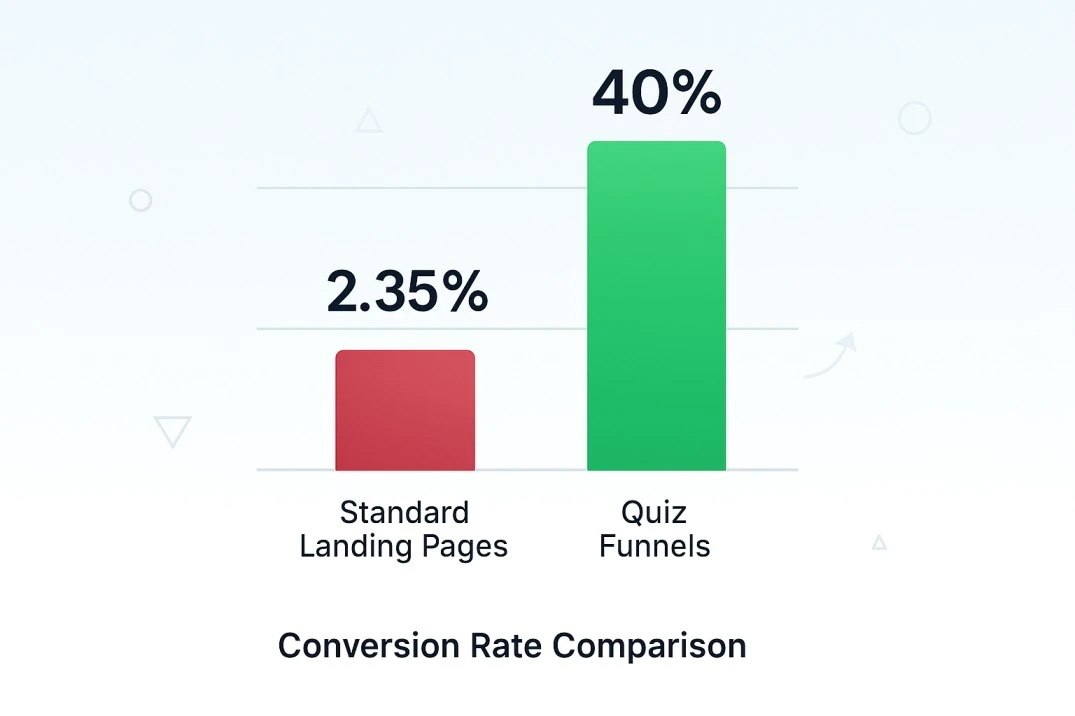

Higher Conversion Rates That Actually Matter

Regular landing pages convert at around 2.35% on average, according to current industry benchmarks for landing page conversion rates. Quiz landing pages? Between 30% and 50%. Interactive quizzes consistently pull 40% or higher because they’re engaging and different from standard forms.

When someone spends 3-5 minutes answering questions, that psychological commitment makes them way more likely to complete it. Interactive content generates conversions 70% of the time, compared to just 36% for passive content like blog posts.

Better Quality Leads

When someone answers questions about their home’s age, location, and current coverage, you’re getting way more than an email address. You’re getting the information you need to qualify them properly. This is what makes a home insurance leads quiz funnel so powerful compared to standard web forms.

A person who takes your quiz and scores low is basically saying, “I need help.” That’s a qualified lead who’s already engaged, not someone just collecting freebies.

Stand Out From Competitors

Most insurance websites look identical. Standard contact forms with zero personality or value upfront.

A well-designed quiz changes that. It’s engaging, provides immediate value, and positions you as the expert. Because quizzes are still uncommon in insurance, you’ll stand out from competitors using boring forms.

Segment Your Leads Automatically

Based on quiz answers, you can automatically segment leads into different follow-up sequences. Someone with an old roof in a hurricane zone gets roof coverage emails. A landlord gets rental property info. A new homeowner gets first-time buyer content.

This personalization happens automatically, letting you focus your time on the most promising prospects.

Step-by-Step: Building Your Home Insurance Quiz Funnel

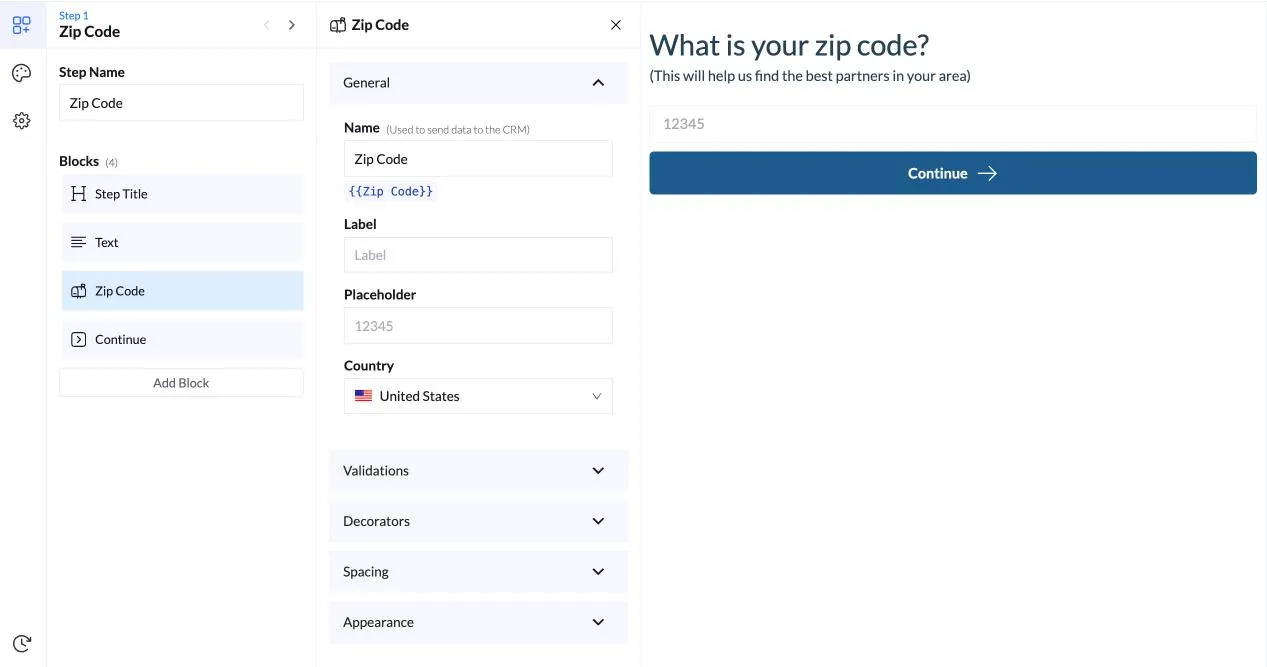

Step 1 – Zip Code:

Start with something easy and non-threatening. Asking for the zip code first helps you qualify leads by location and gets people comfortable answering questions. It also lets you personalize insurance options based on their area’s risk factors.

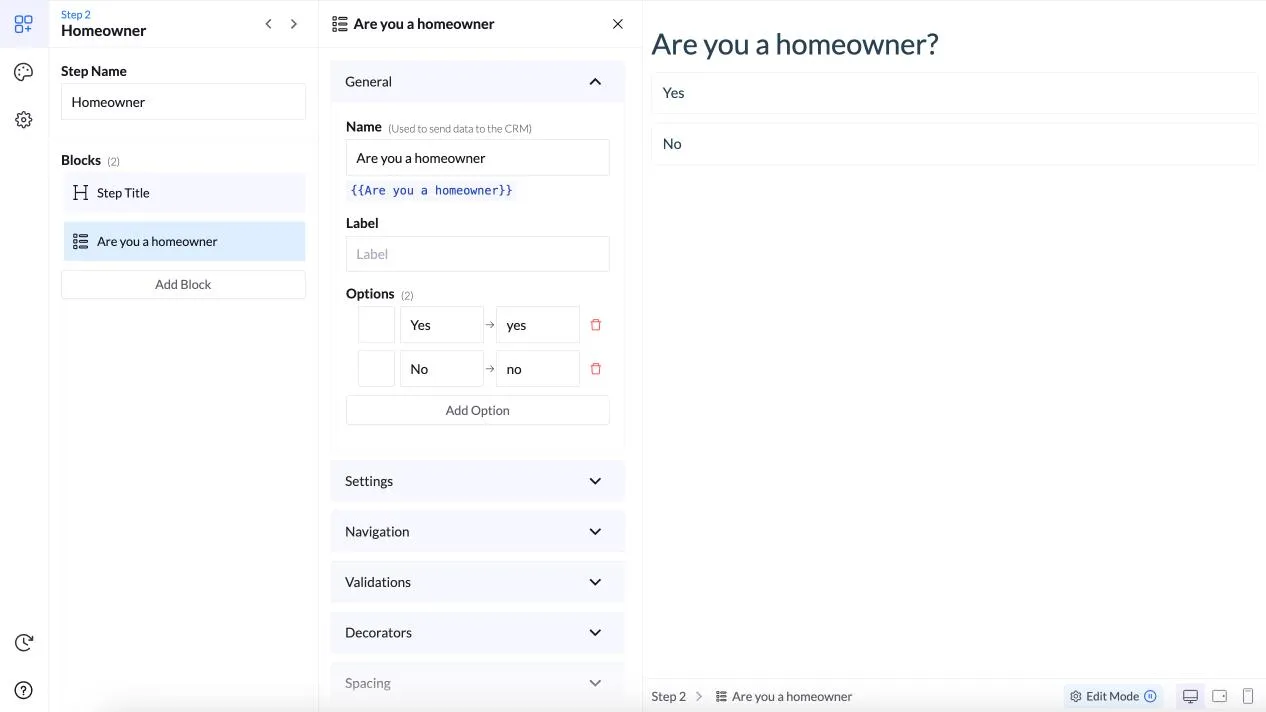

Step 2 – Homeowner:

This is your first major qualifier. If someone answers “No,” you can either end the quiz or branch them to renters’ insurance content. Keep it simple with just two options.

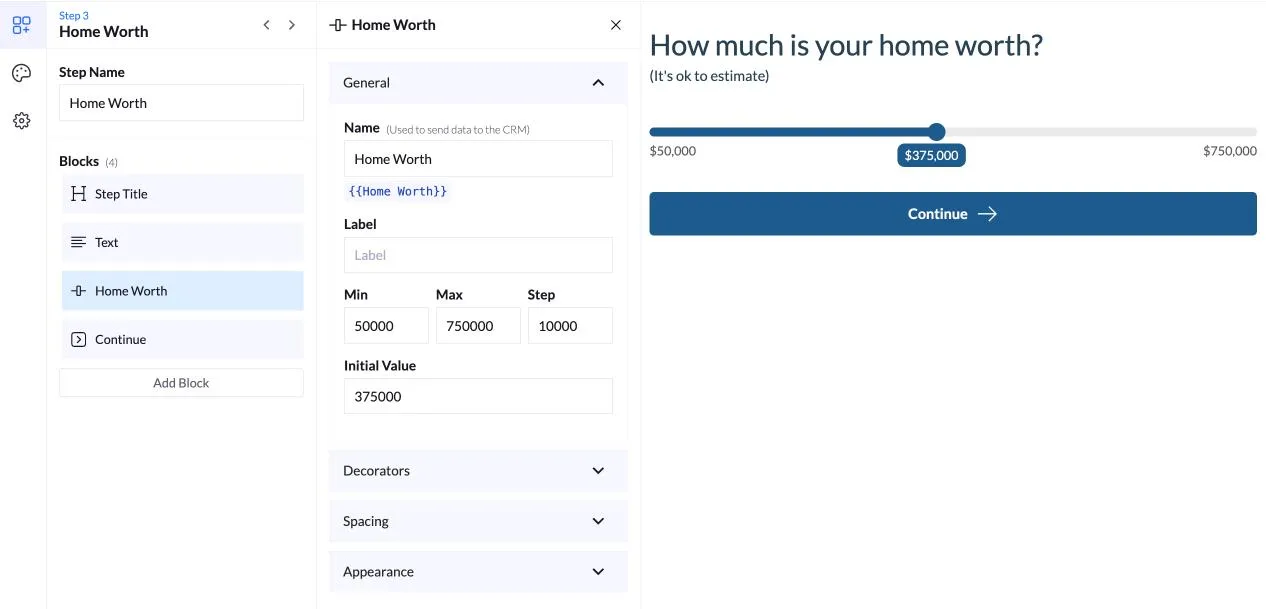

Step 3 – Home Worth:

Using a slider makes this fun and interactive instead of asking people to type a number. The range from $50K to $750K covers most homes. Setting the initial value at $375K gives people a middle ground to adjust from. This approach is common in top-performing home insurance quiz funnel examples because it reduces friction and keeps people moving through the quiz.

Ready to build your own high-performing home insurance quiz funnel?

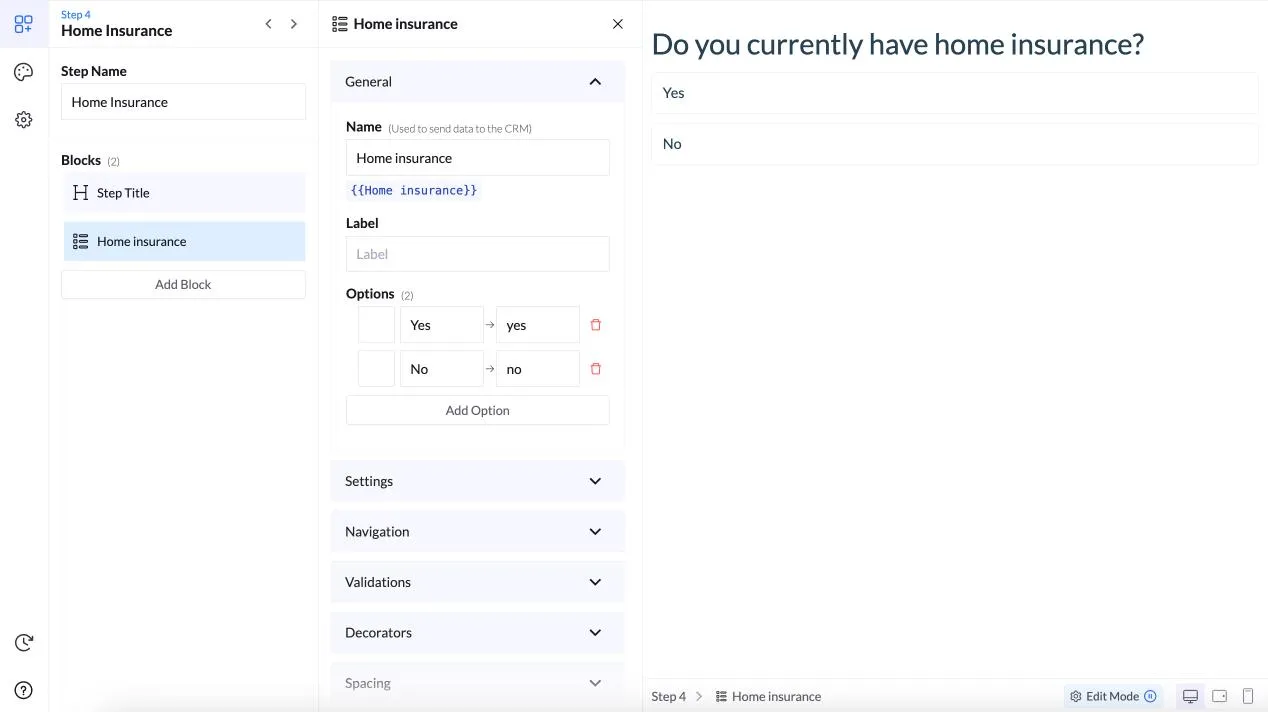

Step 4 – Home Insurance:

Another key qualifier. This tells you if they’re shopping for new coverage or potentially switching providers. People who already have insurance might be more educated buyers, but also harder to convert.

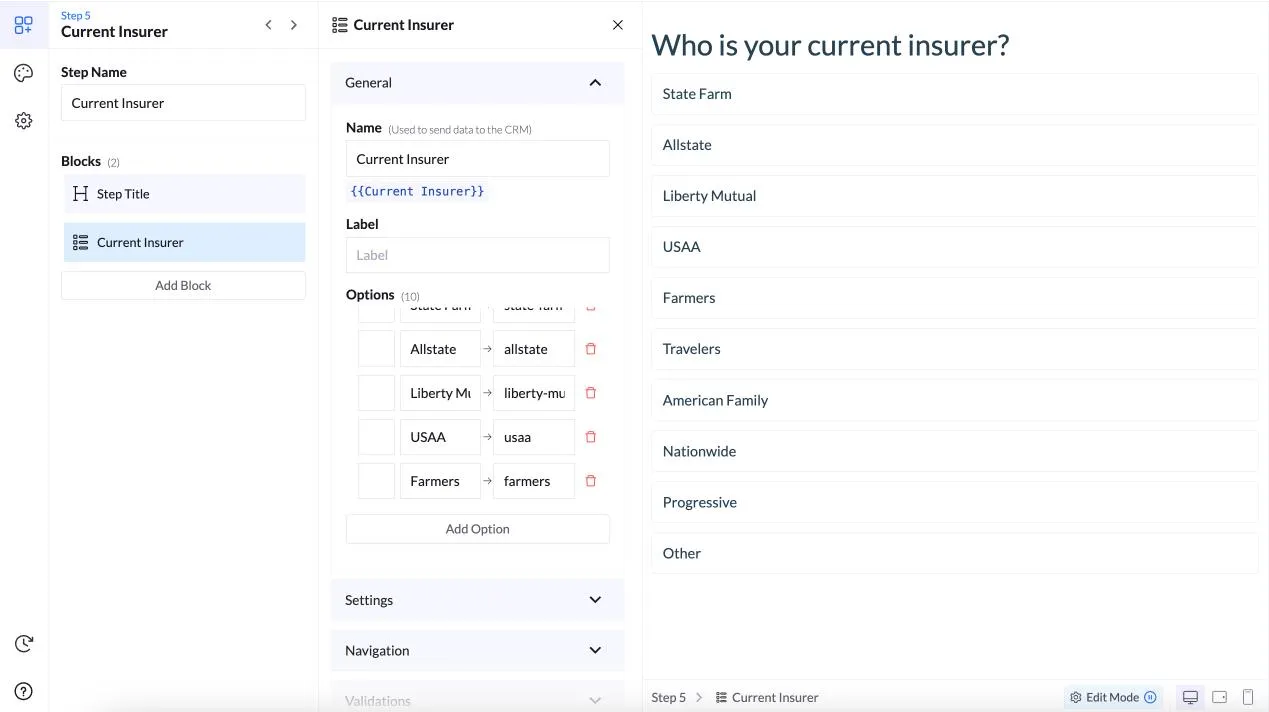

Step 5 – Current Insurer:

Smart move asking this. You learn who your competition is and can tailor your pitch accordingly. Including “Other” catches the smaller providers. This data is gold for your sales team.

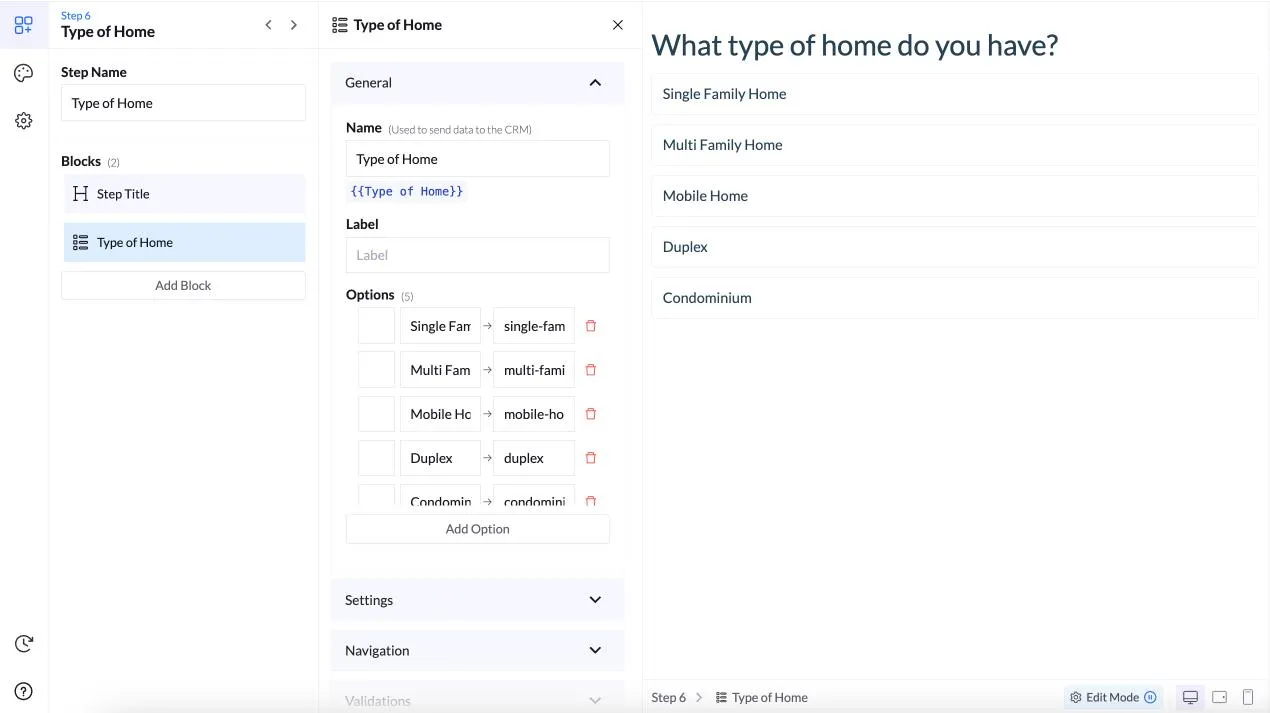

Step 6 – Type of Home:

Different home types have different insurance needs and risk profiles. Single family homes, condos, and mobile homes all require different coverage. This helps you segment leads properly.

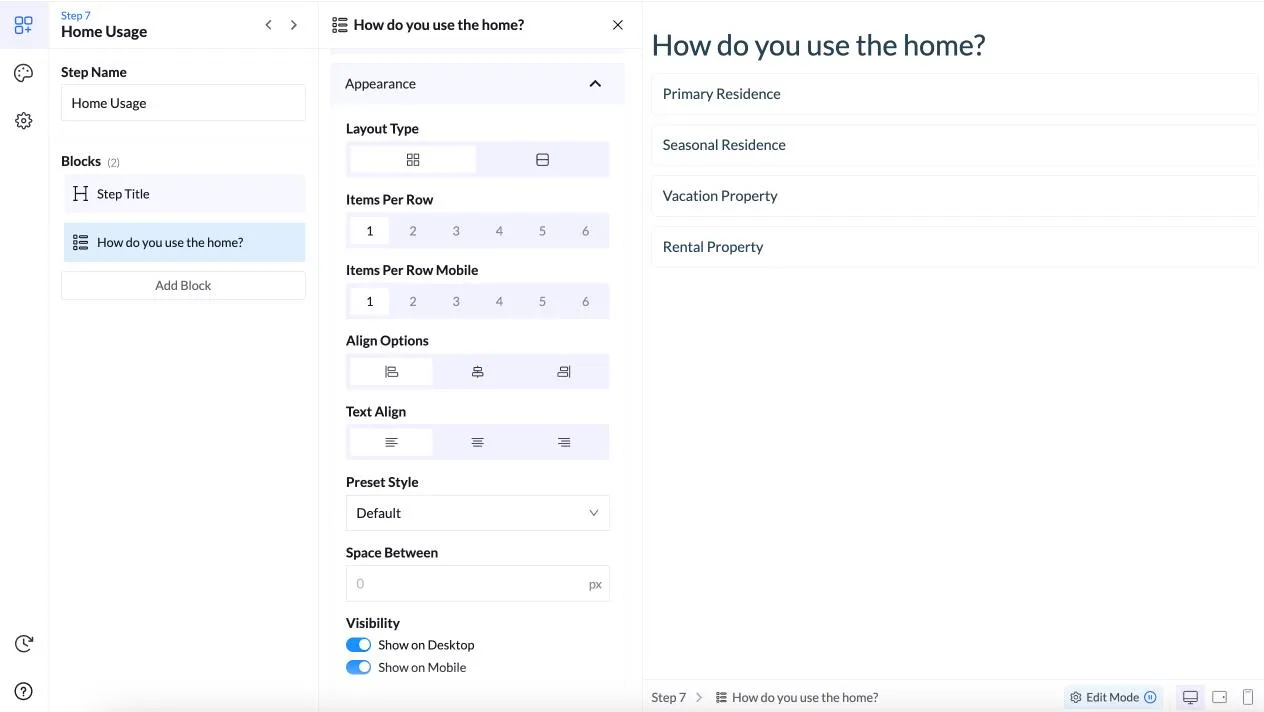

Step 7 – Home Usage:

This matters a lot for pricing. Primary residences get better rates than vacation properties or rentals. Rental properties need different coverage altogether. Good segmentation question.

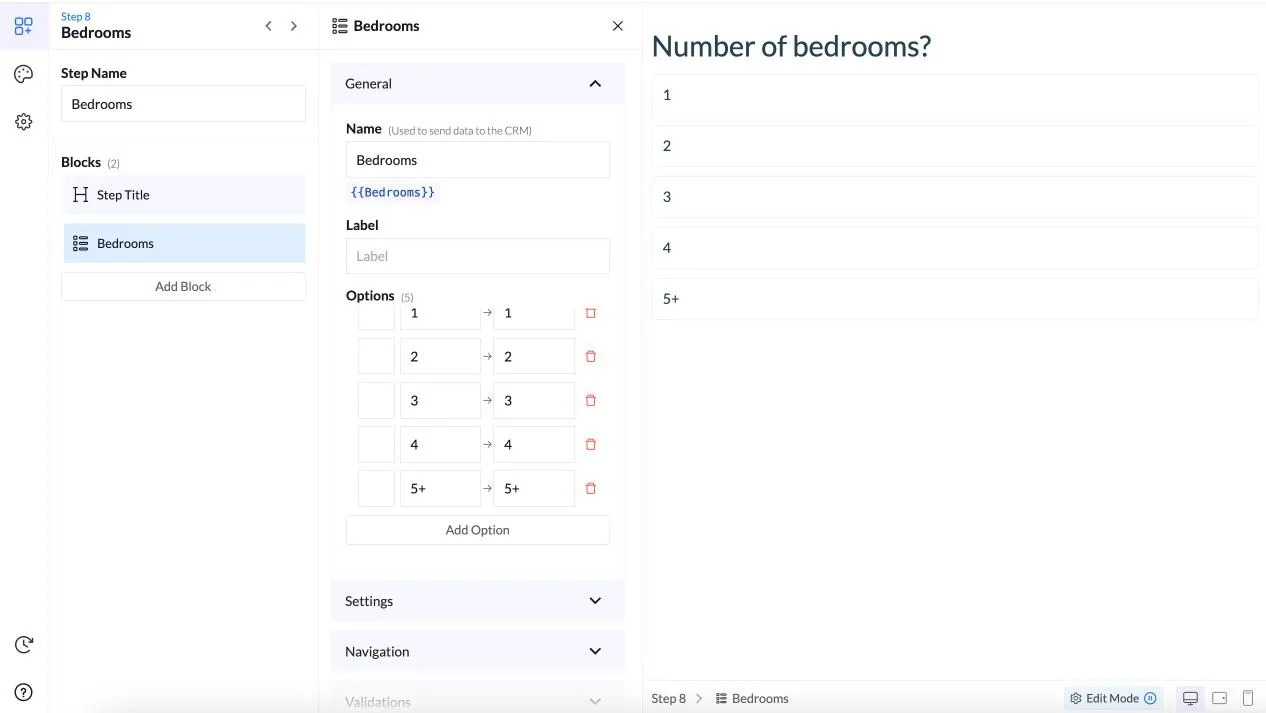

Step 8 – Bedrooms:

This helps estimate home size and value if their earlier estimate seemed off. It’s another data point that makes your quote more accurate and shows you’re being thorough.

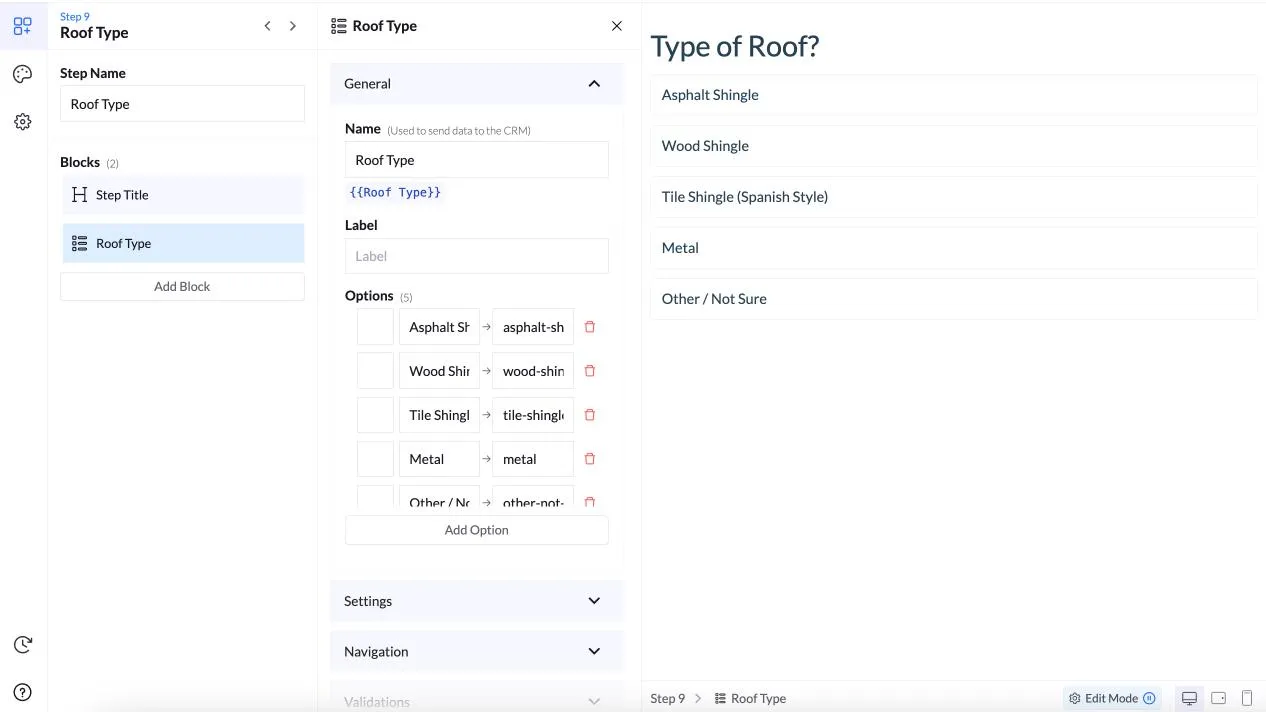

Step 9 – Roof Type:

Roof type affects premiums significantly. Metal roofs get discounts, while wood shingles might increase rates. Including “Other/Not Sure” keeps people from getting stuck if they don’t know.

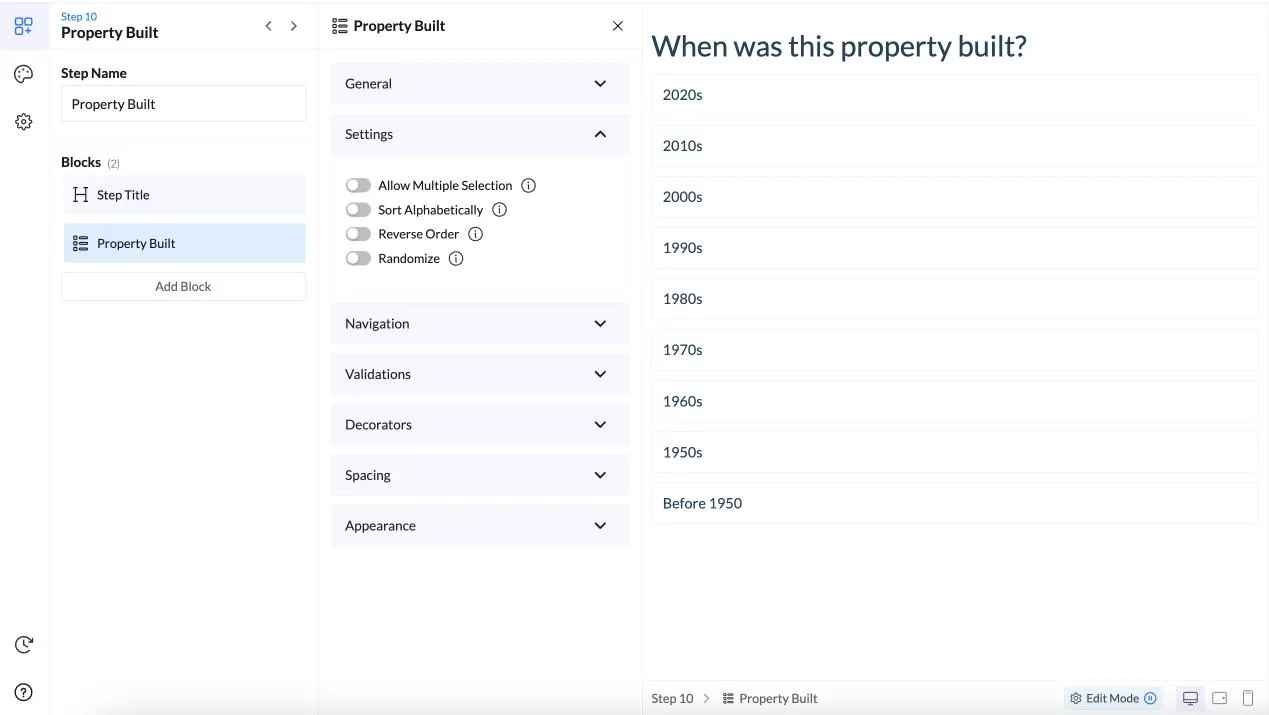

Step 10 – Property Built:

Older homes cost more to insure. Homes built before 1950 might have outdated electrical or plumbing. This by decade makes it easy for people to answer without looking up exact years.

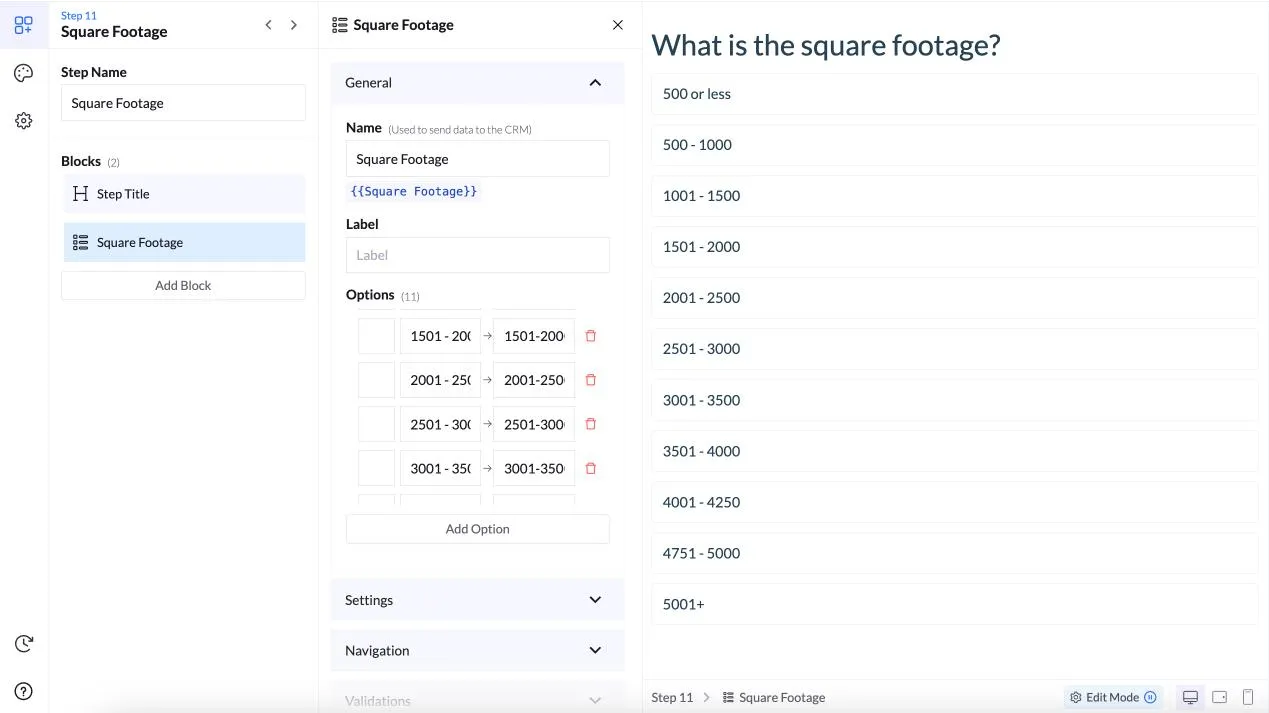

Step 11 – Square Footage:

More specific sizing data. Combine this with bedrooms and home type to validate their home worth estimate. Having broad ranges makes it easy to answer quickly.

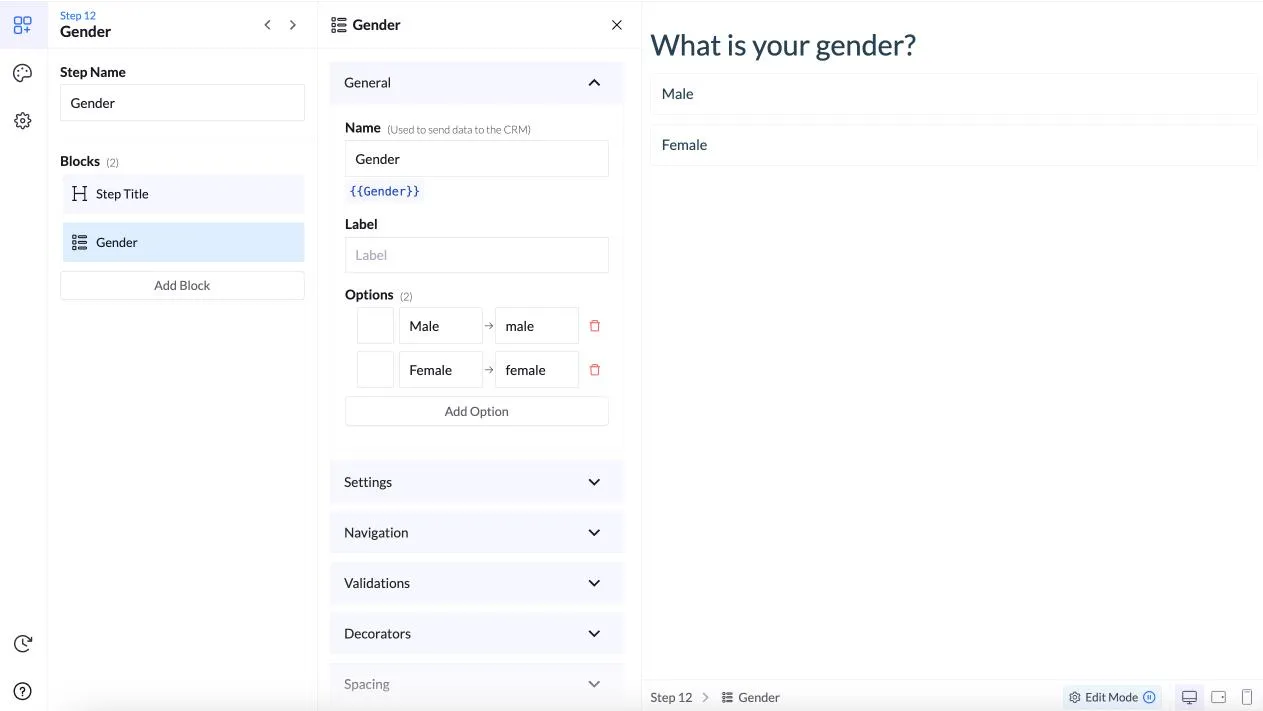

Step 12 – Gender:

Demographic data for your CRM. Some insurers offer different rates based on gender. Keep it simple with just two options to avoid complexity.

Step 13 – Marital Status:

Married homeowners often get better rates. This is standard underwriting info that every insurance company asks for anyway.

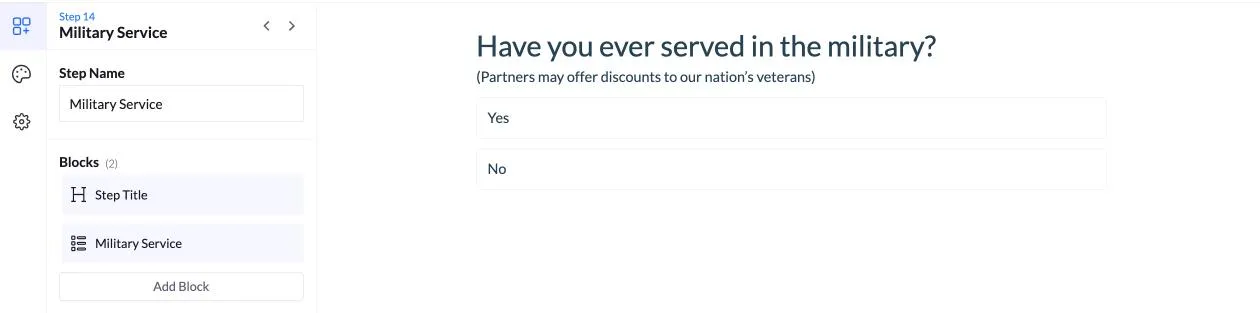

Step 14 – Military Service:

USAA and other insurers offer military discounts. This is a qualifier that could save them money and shows you’re looking out for them. The note about veterans adds context.

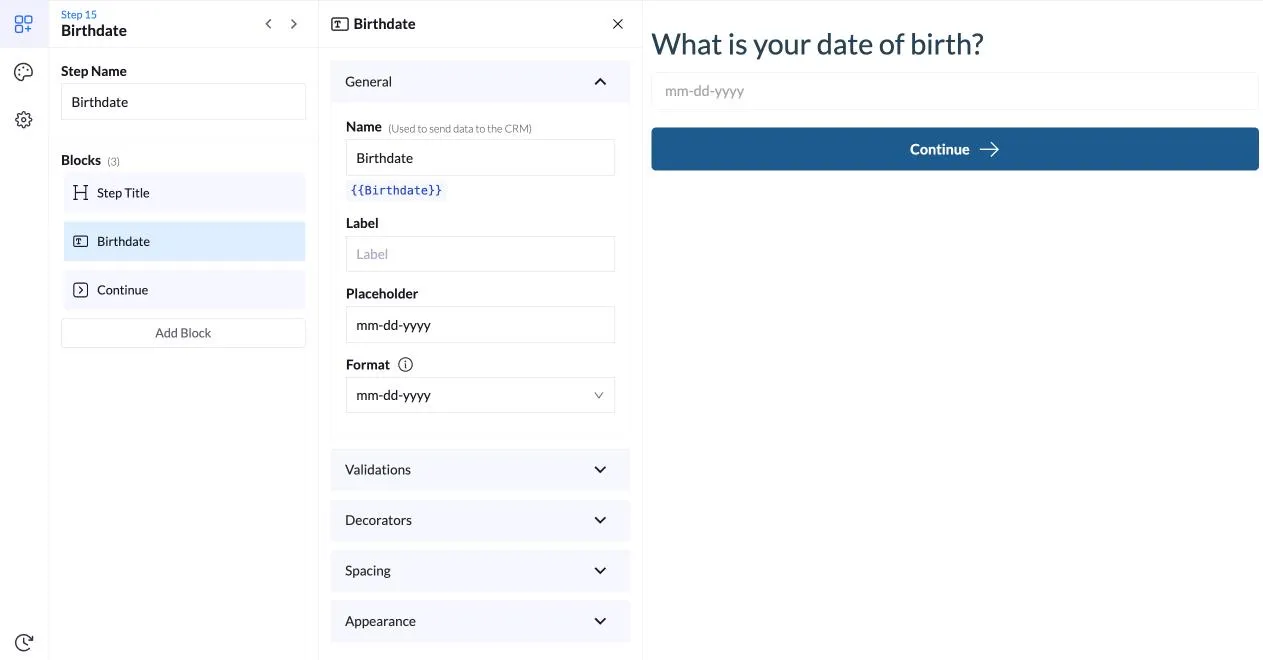

Step 15 – Birthdate:

Age affects rates. Older homeowners typically get better rates because they’re seen as more responsible. The format makes it easy to fill out on mobile.

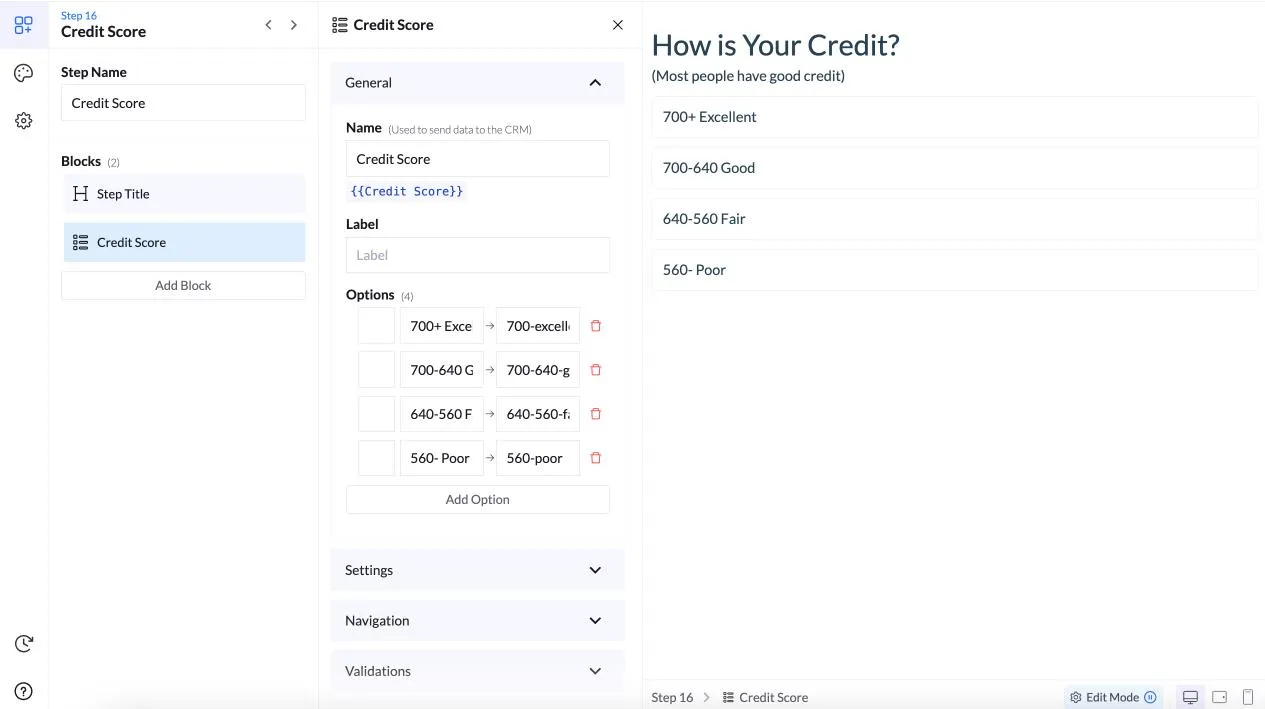

Step 16 – Credit Score:

Credit impacts insurance rates significantly. Using ranges instead of exact scores makes people more comfortable answering. The note “Most people have good credit” reduces anxiety about admitting lower scores.

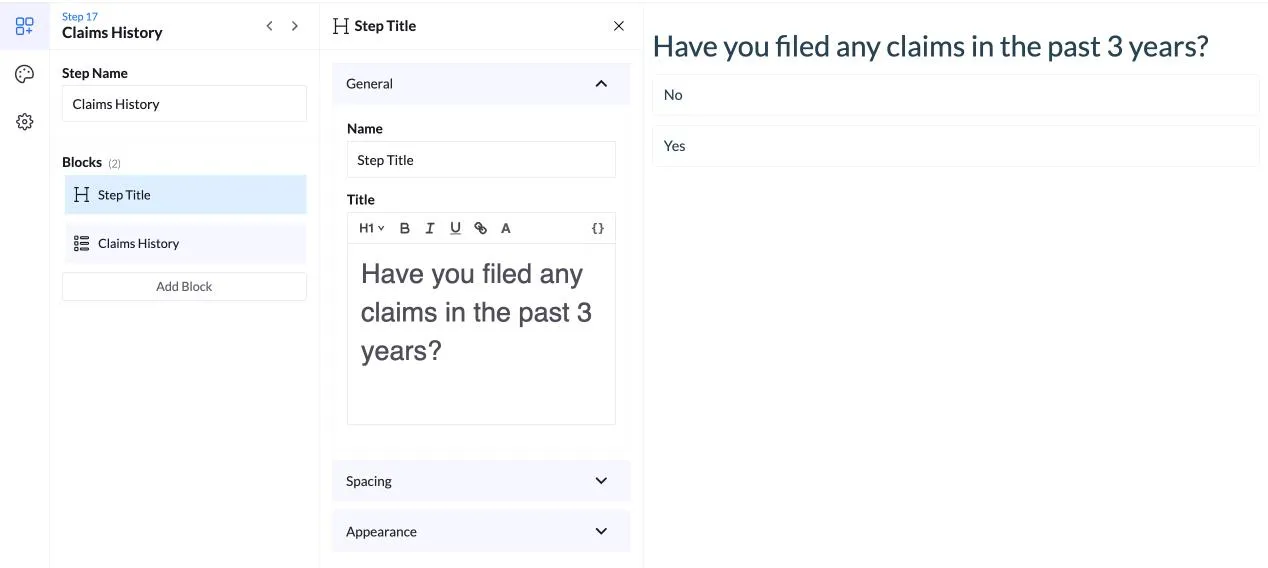

Step 17 – Claims History:

Claims history is one of the biggest rate factors. Multiple claims in 3 years can really drive up premiums. Simple yes/no keeps it moving.

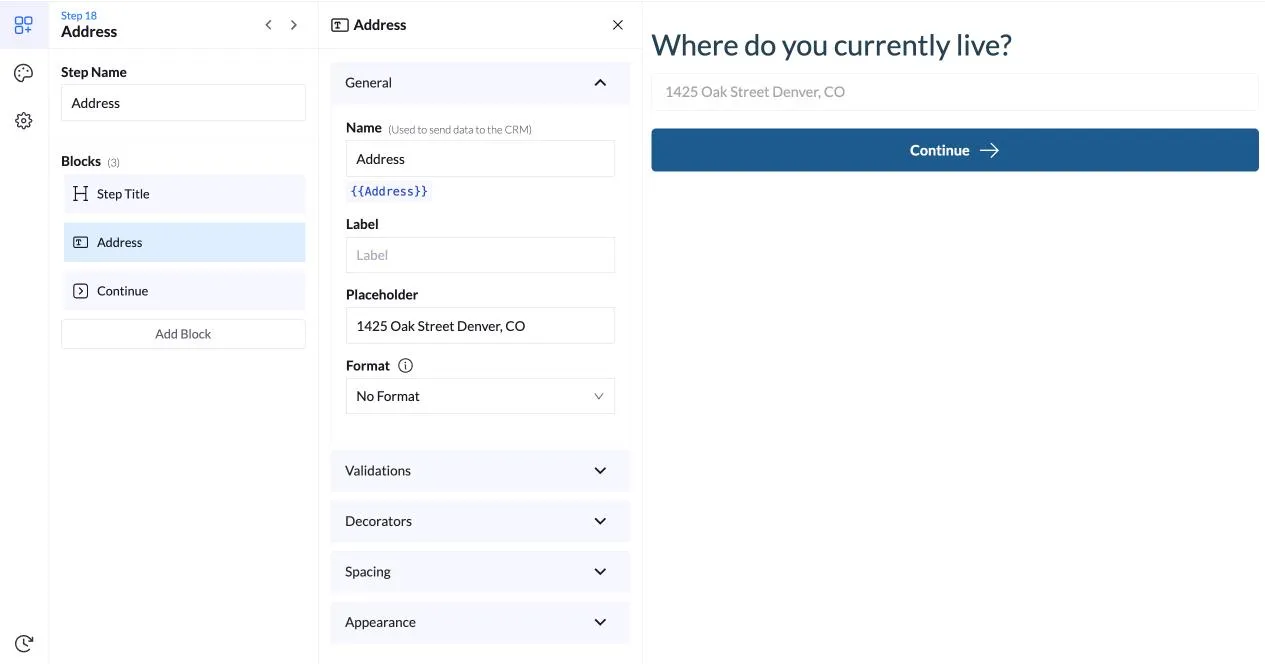

Step 18 – Address:

You need this for accurate quotes since rates vary street by street based on fire protection, flood zones, etc. Putting it near the end means they’re already invested.

Step 19 – Personal Information:

The final lead capture. They’ve invested 2-3 minutes already, so completion rates here should be high. The headline “Your rates are ready to view” creates urgency and promises immediate value.

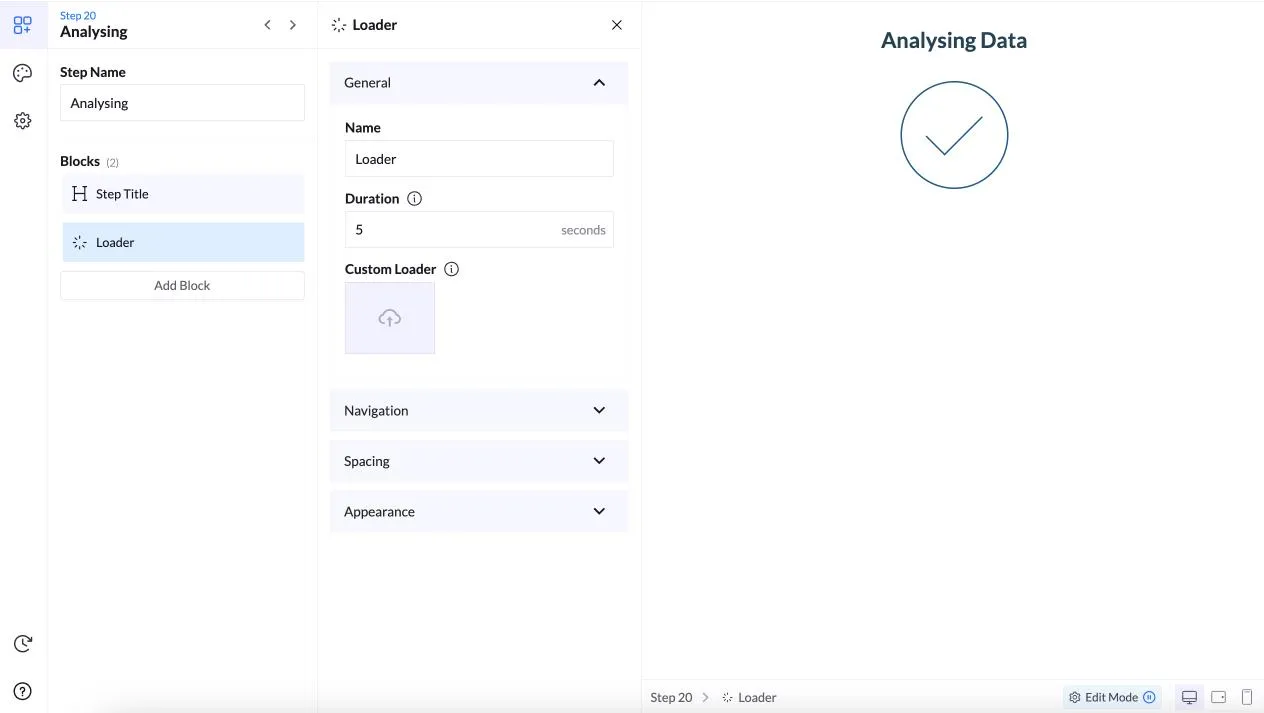

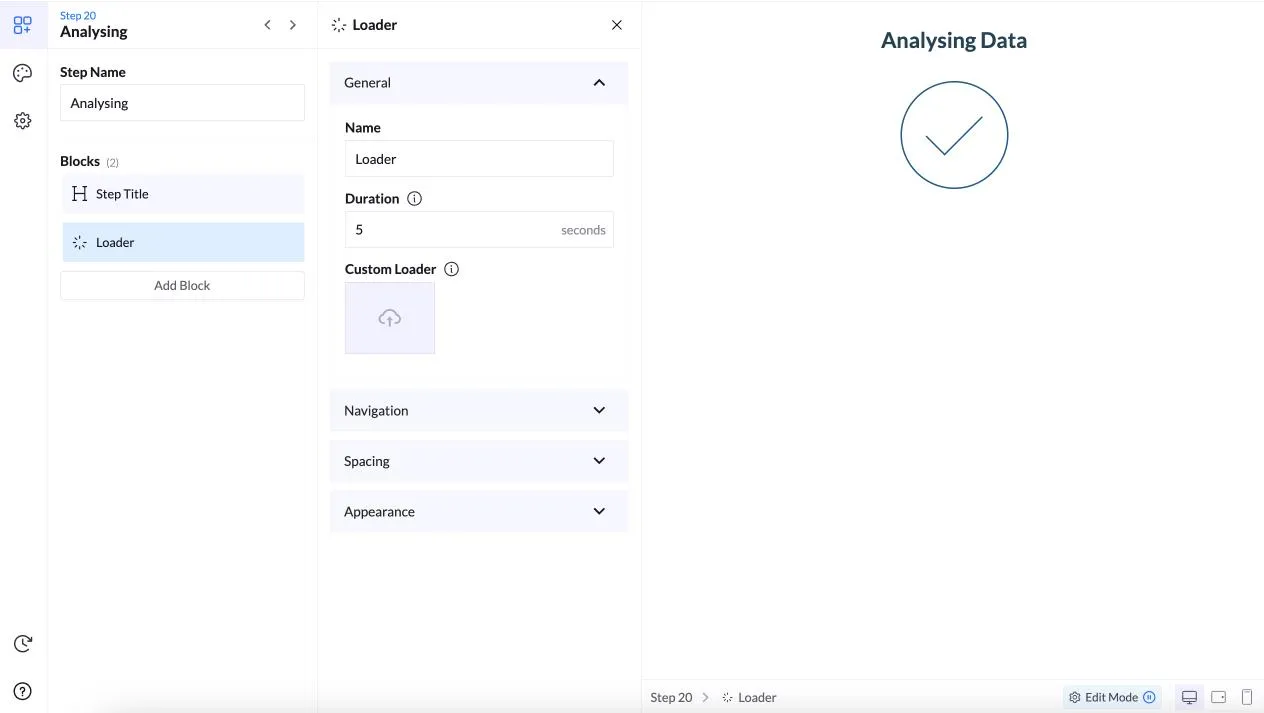

Step 20 – Loading Screen:

The “Analysing Data” loader with a 5-second duration builds anticipation and makes it feel like you’re actually calculating personalized results. This psychological pause increases perceived value.

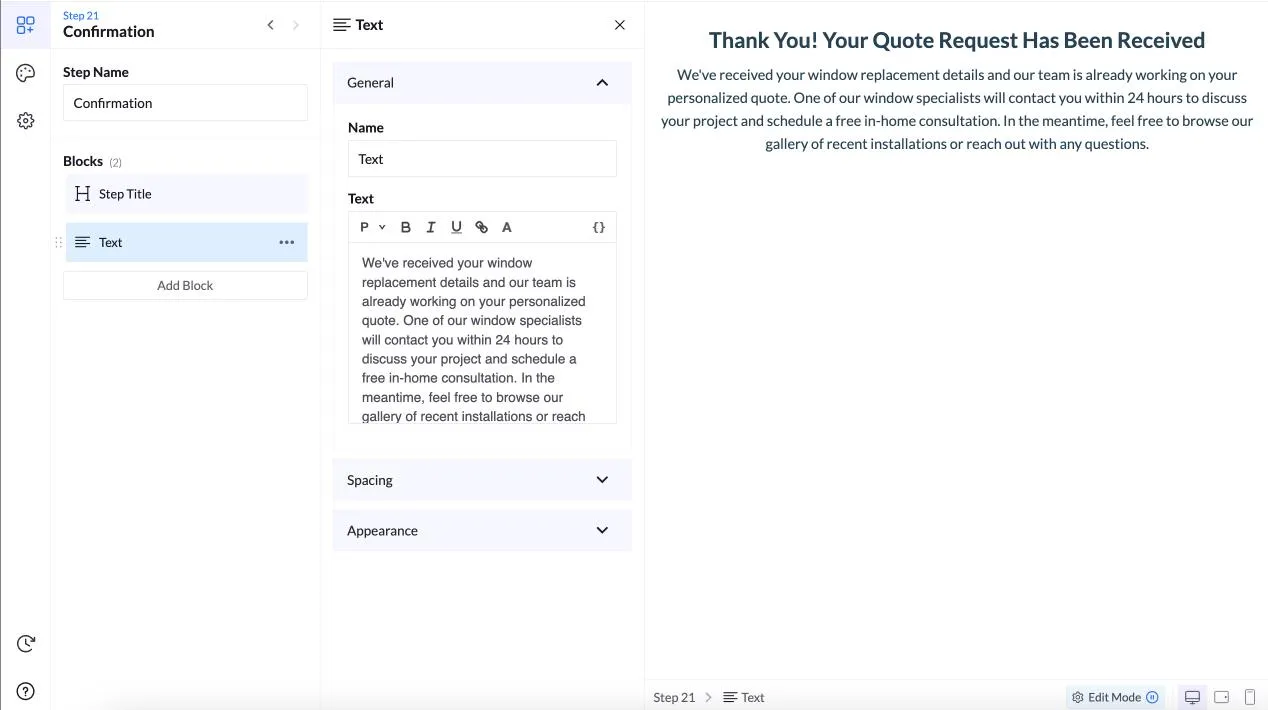

Step 21 – Confirmation Page:

This is your money page. The “Thank You” headline confirms successful completion and reduces anxiety. The copy sets clear expectations (24-hour contact), promises value (personalized quote, free consultation), and gives them something to do while waiting (browse gallery).

See it yourself in action

Common Mistakes to Avoid in Home Insurance Quiz Funnels

Even the best home insurance leads quiz funnel will fail if you make these critical mistakes:

Not Following Up Fast Enough

The first company to respond has a 78% chance of selling its product to a customer. Not the one with the lowest price. Not the one with the best coverage. Just the first one.

If a person takes your quiz and you wait two days to follow up, that person has already spoken to three other agents. Create automatic emails that are sent immediately with their results and the next steps.

Making Questions Too Complicated

“What is your dwelling coverage A limit?” is one of the terms most customers have never heard of.

Keep your language easy to follow. Ask “What would it cost to rebuild your house from scratch?” or “When was the last time your roof was replaced?” These are common knowledge and no one needs an insurance dictionary to answer them.

Ignoring Mobile Users

Mobile devices account for over fifty percent of your website’s traffic. If your quiz is not mobile-friendly, then you are losing a huge number of potential leads. Check it on both phones and tablets. Ensure that the buttons are easily tapable and the text is legible without zooming in.

Not Testing and Optimizing

Keep an eye on your completion rate. Where do people leave? What questions make them confused? Try out different question wordings, result formats, and calls to action to see which works best. It is a standard practice when running A/B tests to improve funnel performance

The agencies that achieve incredible results are not just lucky. They are always improving through small modifications.

FAQ

How much does it cost to build a home insurance quiz funnel?

Landing page builders like LanderLab that include quiz funnel features typically run $89 per month, depending on your plan and lead volume. If you hire someone to design and set everything up for you, expect $2,000-$5,000 for a professional quiz funnel with email automation.

What’s a good conversion rate for a home insurance quiz?

Most quiz funnels convert between 25-35%. If you hit 40% or higher, you’re outperforming the majority of insurance agents. Anything below 20% means you need to simplify your questions or improve your value proposition.

Can I use quiz funnels on Facebook and Google ads?

Yes. You can run paid ads that drive traffic directly to your quiz landing page. Facebook lead ads, in particular, are a good fit for quizzes as they allow users to finish them right on the platform without switching to another site.

Launch Your Home Insurance Quiz

Turn curious visitors into qualified home insurance leads with an interactive quiz funnel built in minutes, no coding or design skills required.