Getting new leads in the insurance industry is more competitive than ever. Potential clients aren’t waiting around.

Insurance search ads average a 5.10% conversion rate, while display ads convert at 1.19%, in line with most other industries.

In this guide, you’ll learn 9 practical insurance lead generation ideas to help you reach more people, earn trust, and convert visitors into qualified leads.

These strategies work for all types of insurance: life, home, auto, commercial, and more.

What is Insurance Lead Generation

Insurance lead generation is the process of attracting and capturing people interested in buying insurance. A lead is someone who fills out a quote form, calls your agency, or shows interest in your services.

The goal is to turn that interest into a sale through follow-ups and helpful content. Modern lead generation uses strategies like landing pages, SEO, paid ads, and email marketing to bring in more qualified prospects.

9 Insurance Lead Generation Examples

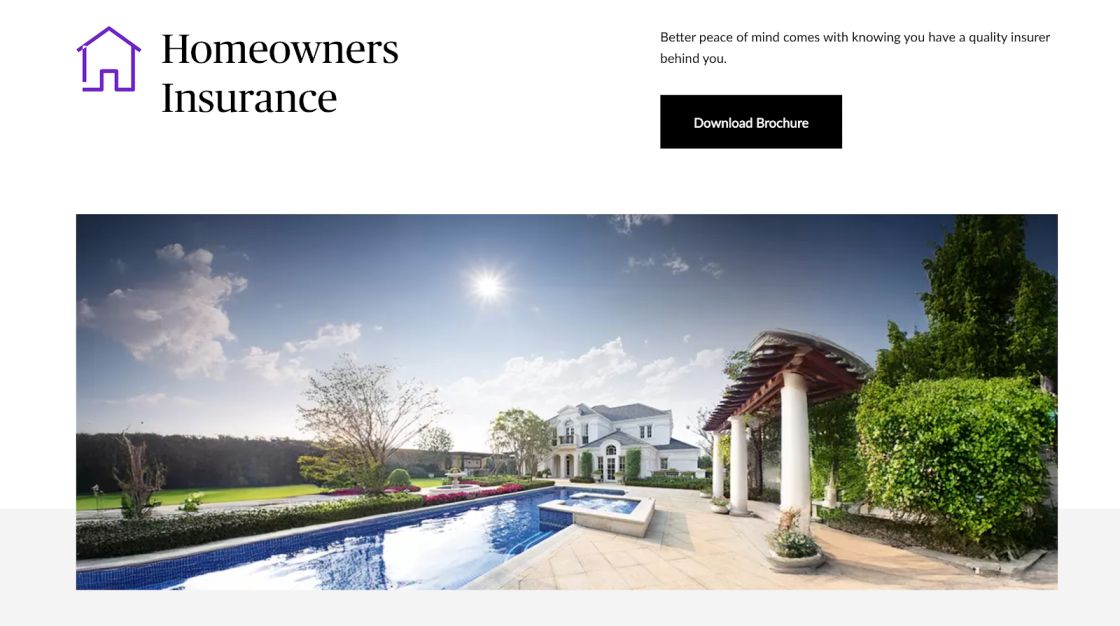

1. Build Insurance Landing Pages That Convert

Your homepage can’t do all the work. To generate quality leads, you need dedicated landing pages for each insurance product and audience type.

A page focused on auto insurance shoppers should look different from one aimed at small business owners.

Instead of listing all your services on one page, create focused pages for:

- Auto insurance

- Life insurance

- Health insurance

- Homeowners insurance

- Business or commercial insurance

Each page should clearly answer:

- What’s covered?

- Who is this for?

- How can someone get a quote?

- What sets your agency apart?

Keep the design simple and mobile-friendly.

Add a short contact form near the top with fields like name, zip code, and coverage need. Include trust signals like customer reviews, agent credentials, or money-back guarantees.

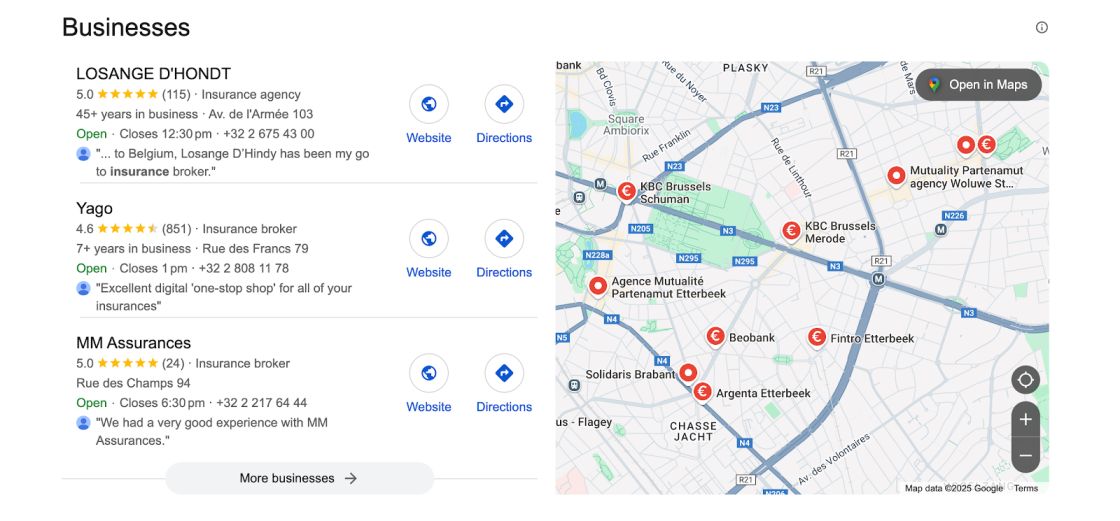

2. Improve Local and Niche SEO to Attract the Right Leads

Many insurance shoppers start with a simple Google search like “life insurance near me” or “small business insurance in Austin.” If your website doesn’t appear on the first page, you’re missing out on high-intent traffic.

That’s where local and niche SEO comes in. Instead of trying to rank for broad terms like “insurance,” focus on specific keywords that match your services and locations. These might include:

- “Auto insurance quotes in Chicago”

- “Affordable health insurance for freelancers”

- “Business liability insurance in Dallas”

To improve your rankings:

- Use relevant keywords in your page titles, meta descriptions, and headings

- Create separate landing pages for each service and city you target

- Add your business name, address, and phone number consistently across your site

- Set up and optimize your Google Business Profile with real photos, accurate info, and customer reviews

SEO takes time, but it’s one of the most reliable ways to generate long-term, high-quality leads without paying for every click.

3. Capture Leads With Smart, Short Forms

You don’t need a long questionnaire to get a lead. In fact, the shorter your form, the higher your chances of converting a visitor into a potential client.

Many insurance websites ask for too much too soon, causing people to abandon the form before hitting submit.

For most pages, 3–4 fields are enough:

- Name

- Zip code or city

- Type of insurance

- Email or phone

Place your form above the fold so it’s visible without scrolling. You can also add it again lower on the page for users who want to learn more before taking action.

Other tips:

- Use clear CTAs like “Get My Free Quote” or “Compare Plans Now”

- Avoid captchas or dropdown overload

- Use mobile-friendly designs with large buttons and fast load times

Smart forms not only improve conversion rates, they also make your agency look easier to work with, which can be a big deciding factor for insurance shoppers comparing options.

4. Use Content Marketing to Attract Insurance Shoppers

When people shop for insurance, they often have questions first. Should I get term or whole life insurance? What’s covered in renters’ insurance? How much business coverage do I need?

That’s where content marketing comes in. Helpful, well-written blog posts, guides, or tools can bring in people who are actively searching for answers.

Start by creating content around common questions in your niche:

- “Best auto insurance options for young drivers”

- “When should you buy life insurance?”

- “How to lower your business insurance premium”

Then, include a clear call-to-action that links to your quote page or product-specific landing page. You can also offer free tools like insurance checklists, premium calculators, or downloadable PDFs in exchange for an email address.

This strategy works especially well for life, home, and business insurance, where buyers tend to research before making a decision.

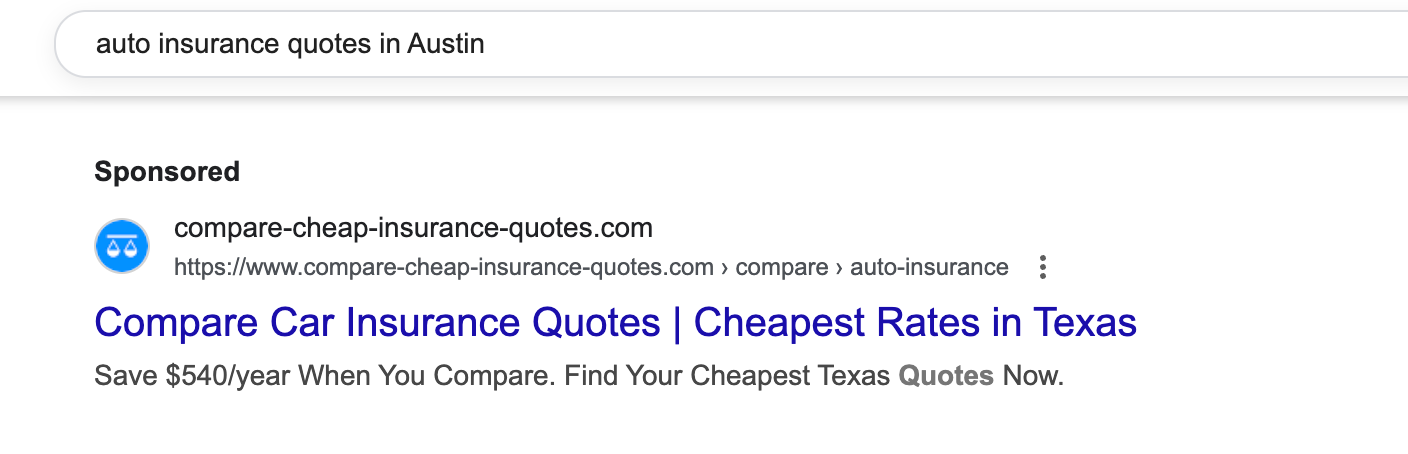

5. Run Geo-Targeted Ads With Matching Pages

When someone searches for “home insurance quotes in Phoenix” or “affordable commercial insurance,” they’re ready to take action.

Paid ads are one of the fastest ways to reach these high-intent searchers (if you use them right).

Start with Google Ads or Local Services Ads. These let you target specific locations and keywords, so you’re only reaching people in your service area.

To make your ads work:

- Use clear, benefit-driven headlines like “Get a Home Insurance Quote in Under 2 Minutes.”

- Include local terms in both your ad and landing page copy

- Match each ad to a dedicated page (not your homepage)

- Add trust signals like “Licensed in [State]” or “5-Star Rated by 200+ Clients”

Social media platforms like Facebook and Instagram can also work well, especially for retargeting visitors who didn’t convert the first time.

Tip: Make sure your landing page mirrors your ad offer. If your ad promises a fast quote, the page should deliver exactly that with a visible form or phone number.

6. Use Email Marketing to Nurture Leads and Upsell Clients

Not every lead is ready to buy today. That’s why email marketing is a key part of your insurance lead generation strategy.

It helps you stay in touch, build trust, and convert cold leads into paying clients over time, especially when you understand the types of leads you’re dealing with.

Start by collecting emails through quote forms, content downloads, or newsletter signups. Then, send helpful follow-ups like:

- A welcome email with key service info

- A quote reminder after 24–48 hours

- Educational content: “How to choose the right coverage”

- Upsell emails: “Already have auto insurance? Add renters’ insurance and save 10%”

Segment your list based on interests (e.g. auto, home, life) so you can personalize your messaging. You’ll get better open rates and more conversions by speaking directly to what someone cares about.

Tip: Make sure all your emails are mobile-friendly, with one clear call to action like “Get My Updated Quote” or “Schedule a Call.”

7. Turn Happy Clients Into Referrals and Reviews

Referrals and online reviews are two of the most cost-effective ways to generate new insurance leads. People trust recommendations from friends and real customers more than any ad.

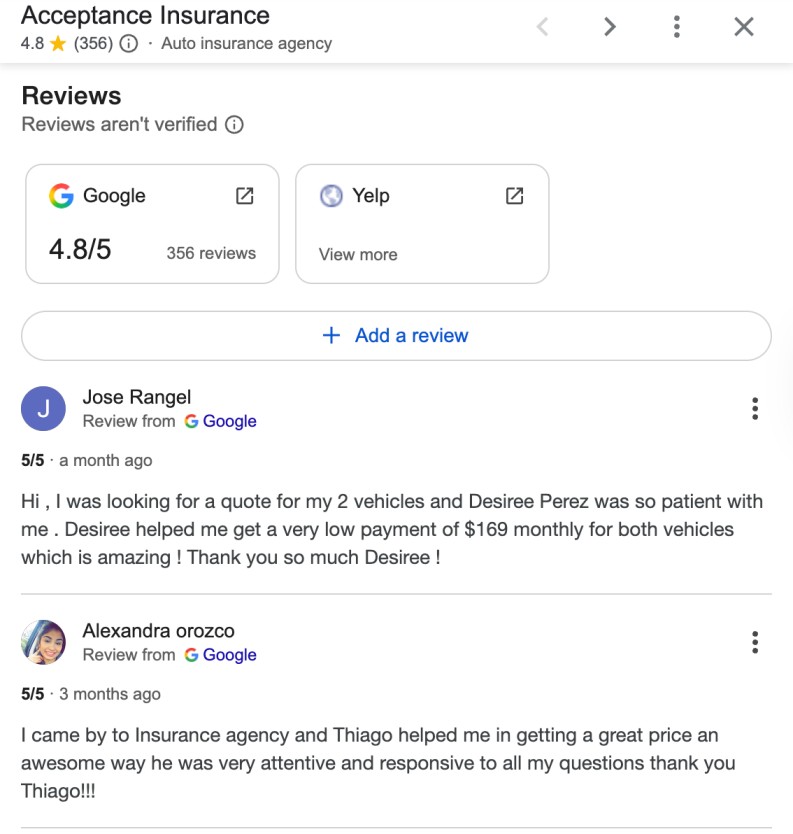

After a policy is sold or a claim is handled smoothly, follow up with a quick message asking for a review. You can include a direct link to your Google, Yelp, or Facebook review page to make it easy.

You can also turn satisfied clients into a steady stream of referrals by offering a small incentive, such as:

- “Refer a friend and get a $25 gift card”

- “Get $50 off your next renewal for each successful referral”

Add referral prompts to:

- Thank-you pages

- Post-sale emails

- Your customer portal or dashboard

Tip: Don’t just collect reviews, use them. Display your best testimonials on landing pages to build trust with first-time visitors.

8. Use Networking and Local Events to Find Leads

While online marketing is essential, face-to-face networking is still one of the best ways to build trust, especially for commercial or high-value insurance products.

Attending local events puts you directly in front of potential clients and referral partners. These might include:

- Chamber of Commerce meetups

- Small business expos

- Real estate networking events

- Community fundraisers or volunteer days

Bring business cards with a QR code that links to a custom quote page or service explainer. If you’re speaking or sponsoring, set up a simple landing page just for the event, something like:

“[Event Name] Attendee Special: Free Business Insurance Consultation”

After the event, follow up with everyone you meet. Even if they don’t need insurance now, they may in the future, or know someone who does.

9. Track, Test, and Improve Your Lead Generation Weekly

The best insurance agencies don’t just launch a campaign and forget about it. They track what’s working, test new ideas, and adjust their strategy to keep leads flowing consistently.

Start by reviewing basic performance metrics:

- How many leads did each landing page generate?

- Which form gets the highest completion rate?

- Which ad or email gets the most clicks?

A/B test one thing at a time. Like headline wording, CTA buttons, or form length. Even small changes can make a big difference.

Also, keep an eye on drop-off points. If people are visiting a page but not submitting the form, it might be too long, too slow, or not answer the right questions.

Block off 30 minutes each week to:

- Review traffic and lead numbers

- Check the top and underperforming pages

- Make 1–2 small improvements

This habit alone can help you generate more leads from the same traffic and avoid wasting time and budget on things that don’t convert.

FAQs

What’s the best way for insurance agents to generate leads in 2025?

The most effective strategy combines online lead generation with offline outreach. Use search engine optimization to attract prospective clients through organic search results, and pair that with direct mail campaigns, referral programs, and attending networking events to connect with business groups and commercial clients.

How can an insurance company attract more qualified leads online?

To generate insurance leads that actually convert, focus on targeted landing pages, SEO, and social media marketing. These methods help you reach your ideal target audience while nurturing potential leads through the sales pipeline. A strong email follow-up strategy also helps cross-sell to existing customers and turn cold leads into new clients.

Should I still use traditional advertising to grow my insurance agency?

Traditional methods like direct mail and print ads can still be extremely helpful, especially when combined with modern strategies. For example, including a QR code in a direct mail piece that links to a quote page helps bridge offline and online lead generation.

Ready to Capture More Insurance Leads?

Create landing pages in minutes that match your insurance offers and convert more visitors into real leads, no coding needed.