In 2026, the mortgage market is more competitive than ever, and capturing qualified leads is no longer about buying lists or chasing cold contacts.

90% of borrowers expect a fully digital mortgage experience, from researching lenders to submitting applications.

But without the right tools, most brokers still struggle to turn that traffic into real clients.

The solution? Build high-converting landing pages, automate your follow-ups, and capture intent the moment it happens.

In this guide, you’ll discover 8 top-rated mortgage lead generation software designed to help you attract borrowers, convert them into leads, and close more deals, all without relying on outdated forms or third-party leads.

What Is Mortgage Lead Generation?

Mortgage lead generation is the method of locating individuals who are currently in the market for a home loan and converting them into possible clients. Lenders used to rely on cold calling and bought lead lists now buyers are searching on the internet for mortgage rates, comparing lenders on their phones, and seeking quick answers without having to call different agents.

Modern lead generation is found in those moments, which means creating simple landing pages or forms where the buyer can share their details easily. With the right programs, you can respond quickly, build trust, and help them through the process until they are ready to close on a loan.

Rather than trying to chase down contacts who are disinterested, mortgage lead generation is about connecting with actual borrowers ready to make a commitment.

Why Lead Generation Matters for Mortgage Professionals

Let’s face it, homebuyers today are not calling their bank first or asking their neighbors for recommendations for brokers. They are pulling out their cell phone at 11 PM and searching Google for “best mortgage rates near me” before ever reaching out to someone.

This is what’s actually happening:

Your competition is already online. You think you are just waiting for the phone to ring, but other brokers are taking leads from Google searches and Facebook ads. They are meeting borrowers where they actually are.

Borrowers need instant answers. The person thinking about refinancing at 9 PM on a Sunday night is not waiting until Monday morning to find a broker or lender; they want a quick form to fill out or an instant rate estimate right now.

Quality is greater than quantity. You could buy 1,000 cheap leads, but how many are actually going to answer when you call? Digital lead generation is attracting people who are actively looking for what you have today, not six months ago when they filled out a random form.

The reality is, your future clients are online right now comparing. You can either be one of those options or hope that someone tells them about you one day.

How to Choose the Right Mortgage Lead Generation Software

If you want to be a top-producing mortgage broker, you need tools that help you get leads consistently. Why do so many mortgage brokers get the tool selection process so wrong? It could be that the marketing and/or technology reporting is distracting mortgage brokers from being the best they can be. Most brokerages don’t follow a lead capture/saving process, but rather just fancy cool stuff that they never use.

Start asking yourself:

1. Can you create a simple lead capture page?

2. Is it mobile-friendly?

3. Does it connect to what you are already tracking leads into? If yes, do you know how you’re going to do it?

Speed is more important than getting it perfect. The mortgage business is not slow, and you will need tools to assist you with executing and launching campaigns quickly. If a tool has hours of training videos just to create a single page or 1 simple task, it’s not for the mortgage broker with limited time to build a lead-generating page.

Follow your budget and plan well. Remember that the monthly fee is just the beginning. You will also have to back in ad dollars that you should budget, setup costs, as well as the time you spend on the platform learning it. A lead generation page tool that costs less, but you learn it in a week, will almost always be better than a lead capturing tool that sits on your computer, because it’s too complex to bother utilizing.

Ultimately, it is not about price, or features, or any of that. The right tool for mortgage brokers is one that leads to capturing leads consistently.

| Software | Best For |

| LanderLab | Creating high-converting landing pages without coding |

| Zoho LandingPage | Simple mortgage forms with built-in CRM for fast follow-up |

| ClickFunnels | Full-funnel automation from opt-in to consultation |

| Leadpages | Mobile-first lead capture for paid ad traffic |

| HubSpot | All-in-one CRM and automation for nurturing mortgage leads |

| Unbounce | A/B tested, conversion-focused landing pages for ad campaigns |

| Instapage | High-performance pages with personalization and heatmaps |

| Mailchimp | Budget-friendly landing pages + email marketing for beginners |

8 Best Mortgage Lead Generation Software

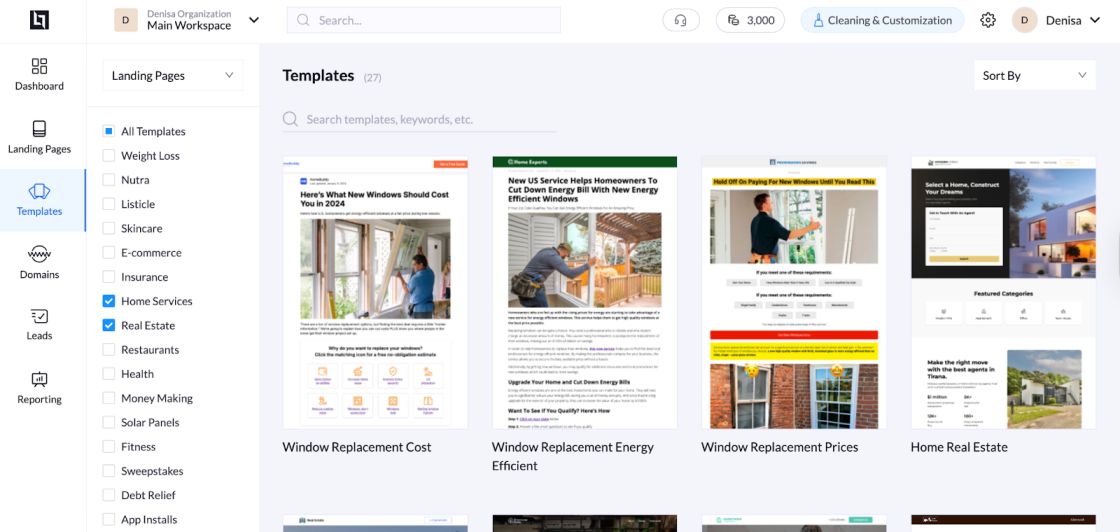

1. LanderLab: Best for Creating High-Converting Mortgage Landing Pages

LanderLab helps mortgage professionals turn ad clicks into real leads with fast, focused landing pages (no coding required).

Instead of sending traffic to a generic homepage, you can create custom landing pages tailored to each loan type, audience, or city: VA loans, FHA, refinance campaigns, or HELOC offers.

But that’s just the start.

From the template dashboard, you can select from dozens of professionally designed pages (real estate, home services, financial, etc.), or you can import your own design and completely customize every section, text or CTA block to meet your campaign needs exactly.

Whether you‘re selling home equity lines in Texas or looking to capture refinance leads in California, LanderLab makes it easy to build pages that convert with mobile-optimized forms, catchy headlines, and location-specific targeting.

You can also duplicate pages across different campaigns and fine-tune them using built-in A/B testing.

This works especially well if you want to build high-converting funnels for:

- Real estate agents are capturing prospective buyers

- Mortgage lenders offering personalized quotes

- Credit unions targeting first-time buyers or aged mortgage leads

- Agencies managing targeted lead generation campaigns

Key Features:

- Drag-and-drop page builder made for speed

- Pre-built templates for mortgage, finance, and real estate

- Lead capture forms optimized for mobile

- A/B testing to find what converts best

- Duplicate and edit pages for multiple campaigns or cities

- Multi-user access for teams and agencies

- Import other landing page layouts and customize as needed

Why it works for mortgage leads:

You can launch and test multiple offers, from “Low Credit Score Mortgage” to “Pre-Approved VA Loans,” and connect those pages to your CRM or email automation tools.

This shortens the follow-up process and helps generate quality leads faster, without relying on cold calling or aged lists.

The flexibility also means you’re not limited to a mortgage. You can create funnels for real estate partnerships, refinance leads, or even upsell other services like home insurance or home equity loans.

Pricing: Starts at $89/month, with a 7-day free trial.

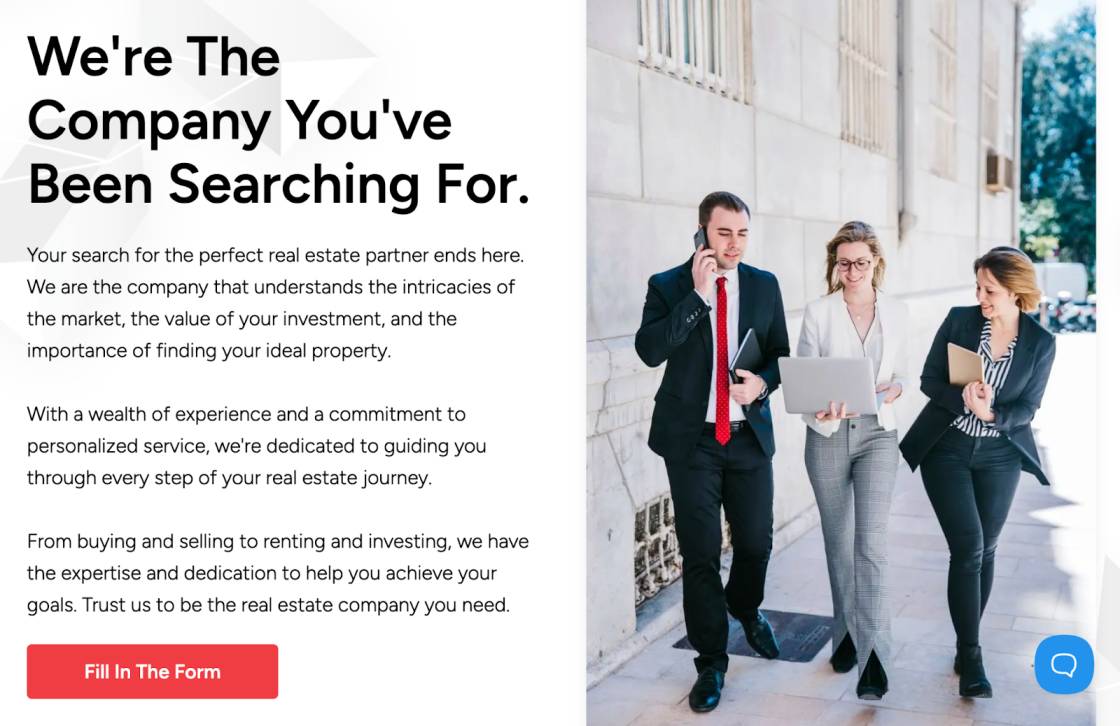

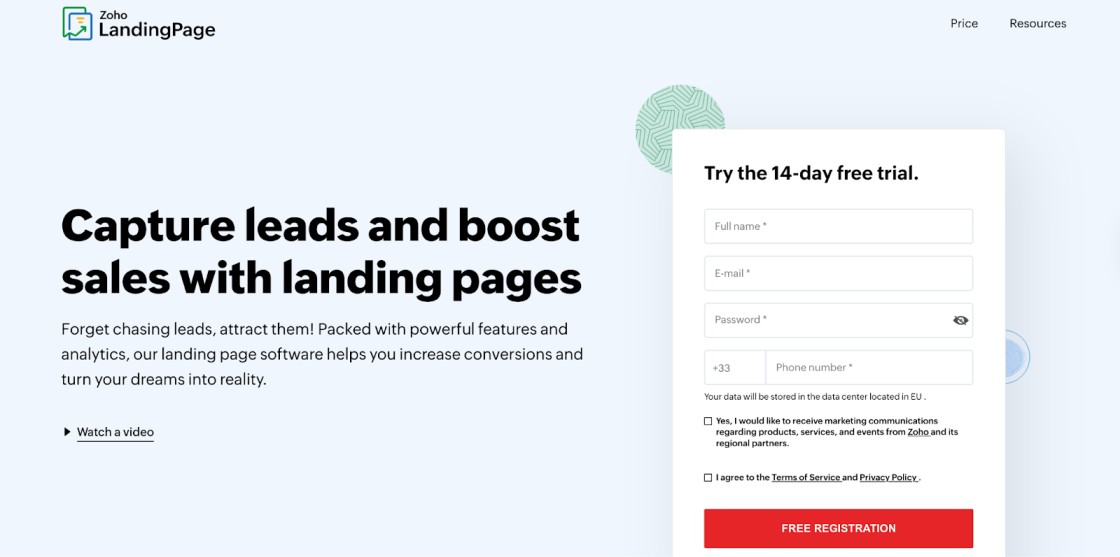

2. Zoho LandingPage: Best for Simple Mortgage Lead Capture Forms

Zoho LandingPage is a solid choice for mortgage brokers and small lending teams who need to capture leads without managing multiple tools.

As part of the larger Zoho ecosystem, it lets you build clean, no-code landing pages, add lead forms, and immediately sync them with your CRM or email automation.

If your goal is to get up and running fast, especially if you’re already using Zoho CRM or Zoho Marketing Hub, this tool keeps things streamlined.

You won’t need third-party integrations, dev help, or a custom domain to start collecting qualified mortgage leads.

Key Features:

- Easy drag-and-drop builder with mortgage templates

- Built-in lead scoring and CRM sync

- Responsive forms and mobile-first layouts

- A/B testing and heatmap analytics

Why it works for mortgage professionals:

You don’t need to set up a full tech stack. Zoho lets you build, capture, and follow up within the same ecosystem. It’s suitable for lean mortgage teams who want fast implementation and clear visibility into their pipeline.

Pricing: Starts at $23/month (included with Zoho Marketing Suite)

3. ClickFunnels: Best for Full Mortgage Funnel Automation

ClickFunnels is a complete sales funnel platform designed to guide mortgage prospects from awareness to conversion.

Instead of stopping at a single lead capture form, you can build multi-step funnels with upsells, nurturing sequences, and automated follow-ups built right in.

This works well for mortgage professionals who want to educate, qualify, and convert leads over time.

Whether you’re running paid ads for first-time buyers or building a webinar funnel for refinance leads, ClickFunnels helps you design the entire journey without any code or extra tools.

Key Features:

- Funnel templates tailored to mortgage brokers

- Built-in forms, email follow-up, and SMS workflows

- Webinar and consultation booking integrations

- Analytics, A/B testing, and upsell tracking

Why it works for mortgage professionals:

You can build longer customer journeys (e.g. a first-time homebuyer education series) that nurture and qualify leads automatically.

Pricing: Starts at $97/month.

Curious about better or more affordable options than ClickFunnels? Don’t miss our roundup: ClickFunnels alternatives.

4. Leadpages: Best for Mobile-Friendly Mortgage Forms

Leadpages is built for speed, both in how quickly you can launch a page and how fast it loads for mobile users.

If you’re running mortgage lead generation campaigns through Meta, Instagram, or Google Ads, chances are your audience is clicking from their phone. That’s where Leadpages proves its value.

With dozens of clean, high-converting templates tailored to home value checks, loan program interest, or local refinance offers, you can launch mobile-first pages in minutes and connect them to your CRM or email marketing tool.

Key Features:

- Mortgage landing page and lead magnet templates

- Mobile-optimized layouts with instant load times

- CRM and email integrations (Mailchimp, HubSpot, etc.)

- Popups and alert bars for additional conversion boosts

Why it works for mortgage professionals:

Most borrowers click from mobile. Leadpages ensures your forms load instantly, look trustworthy, and convert well, even on slower devices.

Pricing: Starts at $49/month.

If you’re exploring other options beyond Leadpages, check out our full comparison in this guide: Leadpages alternative.

5. HubSpot: Best for Managing and Nurturing Mortgage Leads

HubSpot is a full marketing and CRM suite built to help mortgage professionals attract, qualify, and convert leads at every stage of the funnel.

From refinance calculators to FHA loan interest forms, you can build lead capture pages and instantly trigger automated email follow-ups, SMS reminders, or even live chat prompts, all based on how the lead interacts with your page.

It’s suitable for mortgage teams that want to stay organized, personalize outreach, and never miss a follow-up.

Key Features:

- Drag-and-drop form builder with smart personalization

- Built-in CRM to manage contacts, pipelines, and deal stages

- Email marketing and behavior-based automation workflows

- Live chat and chatbot tools for instant engagement

- In-depth analytics for tracking page and campaign performance

Why it works for mortgage professionals:

HubSpot brings everything into one platform (from landing pages to nurturing workflows), making it easier to manage leads across multiple sources, loan programs, and sales reps.

Pricing: Free CRM and tools are available. Paid plans start at $90/month, depending on contact volume and features.

6. Unbounce: Best for Conversion-Focused Landing Pages

Just like LanderLab, Unbounce is a dedicated landing page builder that helps mortgage professionals create high-converting pages without writing code.

It’s especially useful for running paid ad campaigns (like Google or Meta) where every click counts.

With tools like Smart Traffic (AI-based optimization) and dynamic text replacement, you can match ad copy to landing pages automatically and maximize conversion rates for refinance, FHA, VA, or first-time buyer campaigns.

Key Features:

- Drag-and-drop builder with templates for finance, real estate, and lending

- AI-powered Smart Traffic to send visitors to the highest-converting page variant

- Dynamic keyword replacement for Google Ads

- Built-in A/B testing and detailed conversion analytics

- Integrates easily with CRMs, email tools, and ad platforms

Why it works for mortgage professionals:

Unbounce gives mortgage brokers and agencies full control over their lead capture process, allowing them to launch fast, mobile-optimized pages tailored to each loan type or location.

It’s great for teams that test and scale campaigns across multiple borrower segments.

Pricing: Starts at $99/month. All plans include unlimited landing pages, with traffic and feature limits based on tier.

Looking for more tools like Unbounce? Explore our full list here: Unbounce alternatives.

7. Instapage: Best for Enterprise-Grade Mortgage Landing Pages

Instapage is a premium landing page builder that’s well-suited for mortgage lenders running large ad campaigns.

It gives you full design flexibility, fast page load times, and deep integrations with ad platforms like Google and Meta, making it easier to turn clicks into high-quality mortgage leads.

It’s especially useful for teams that want personalization at scale or are managing multiple loan types, regions, or agents.

Key Features:

- Enterprise-level page builder with advanced customization

- 500+ layouts, including finance and mortgage templates

- AdMap for syncing ads with matching landing pages

- Heatmaps, A/B testing, and analytics

- CRM and marketing tool integrations (HubSpot, Salesforce, etc.)

Why it works for mortgage professionals:

Instapage lets you personalize landing pages based on ad data, such as loan type or ZIP code, and test what works. It’s suitable for mortgage teams who want a high-converting, branded experience without coding.

Pricing: Starts at $99/month. Custom pricing is available for enterprise users.

Want to see how Instapage stacks up against other landing page tools? Read our breakdown here: Instapage alternatives.

8. Mailchimp: Best for Simple Mortgage Forms + Email Nurturing

Mailchimp isn’t just for email newsletters; it also includes a lightweight landing page builder that’s great for mortgage professionals just starting out.

You can create basic lead capture forms, connect them to automated email follow-ups, and manage your contacts all in one dashboard.

It’s a smart pick for solo brokers or lean teams running small campaigns.

Key Features:

- Drag-and-drop landing page builder with finance templates

- Customizable sign-up forms and interest checklists

- Built-in email marketing and automation

- Lead tagging, segmentation, and CRM-lite features

- Integrates with Calendly, Stripe, HubSpot, and more

Why it works for mortgage professionals:

If you’re launching a simple refinance campaign or capturing first-time homebuyer interest, Mailchimp gives you all the basics, without needing multiple tools or a developer.

Pricing: Free plan available (up to 500 contacts). Paid plans start at $8/month.

Ready to Capture More Mortgage Leads?

With LanderLab, you don’t have to rely on shared lists or expensive lead brokers.

Instead, you can build fast, high-converting landing pages that attract the right borrowers from your ads, emails, or organic traffic, and convert them instantly.

If you’re promoting FHA loans, VA loans, or refinance offers, LanderLab helps you:

- Design and launch mortgage-specific pages in minutes (no dev needed)

- Capture and qualify leads with mobile-friendly forms

- Test, optimize, and scale your campaigns with A/B tools

- Sync leads with your CRM or email platform

Start turning your traffic into real applications with LanderLab, free for 7 days!

FAQs About Capturing Mortgage Leads in 2026

What’s the most effective way to capture mortgage leads online?

The best strategy is to use digital marketing tools like LanderLab to build targeted, high-converting landing pages. Instead of buying aged leads, create a lead capture process tailored to your loan programs, location, and audience, then connect it to your CRM for faster follow-up.

How do I make sure the leads I collect are qualified?

Focus on asking the right questions upfront, like loan amount, purchase price, credit range, and ZIP code. Tools like LanderLab let you build custom forms that filter out unqualified traffic and increase the chances of real interest and repeat business.

Why is landing page optimization so important for mortgage lead generation?

Because most borrowers click from mobile ads or emails, and you have just seconds to grab attention. A slow or generic page kills conversions. Optimized pages: with clear CTAs, trust signals, and mobile-first design, help you stand out and boost ROI on every campaign.

Start Capturing Mortgage Leads

Build mortgage-specific landing pages in minutes with LanderLab.

Capture qualified leads, automate follow-ups, and close more home loans without coding.